Payments to Members of Llanelli Rural Council

Under the Local Government (Wales) Measure 2011, community and town councils are relevant authorities for the purpose of remuneration.

Consequently, individuals who have accepted office as a member (councillors) of Llanelli Rural Council are entitled to receive payments as determined by the Independent Remuneration Panel for Wales (IRPW). It is the duty of the proper officer of the council (the Finance Manager in this instance) to arrange for correct payments to be made to all individuals entitled to receive them.

A member may decline to receive part, or all, of the payments if they so wish. This must be done in writing and is an individual matter. Any member wishing to decline payments must themselves write to the proper officer to do so.

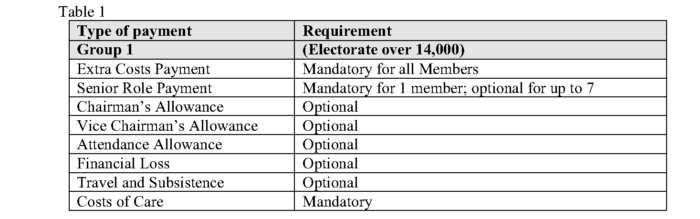

For remuneration purposes the council is categorised as a group 1 council because its electorate is in excess of 14,000 electors. Table 1 below sets out the type of payments the council must (mandatory) or may (optional) make to its members:

Making Payments to Members

All members, including co-opted members, are entitled to claim a contribution towards the costs of care and personal assistance, for activities the council has designated official business or an approved duty which might include appropriate and reasonable preparation and travelling time.

Costs of care and personal assistance payments are taxable under the current HMRC rules so full reimbursement is not possible. Claims can be made in respect of a dependent under 16 years of age, or a minor or adult who normally lives with the member as part of their family and who cannot be left unsupervised. Receipts must accompany claims. A contribution towards costs of care and personal assistance payments will be authorised for:

- Formal (registered with Care Inspectorate Wales) care costs to be paid as evidenced;

- Informal (unregistered) care costs to be paid up to a maximum rate equivalent to the Real Living Wage hourly rate as defined by the Living Wage Foundation at the time the costs are incurred.

In respect of the other mandated payments, no decision is required and members shall receive monies to which they are properly entitled as a matter of course.

The council may adopt any, or all, of the non-mandated determinations set out below but in doing so, they must apply to all its members.

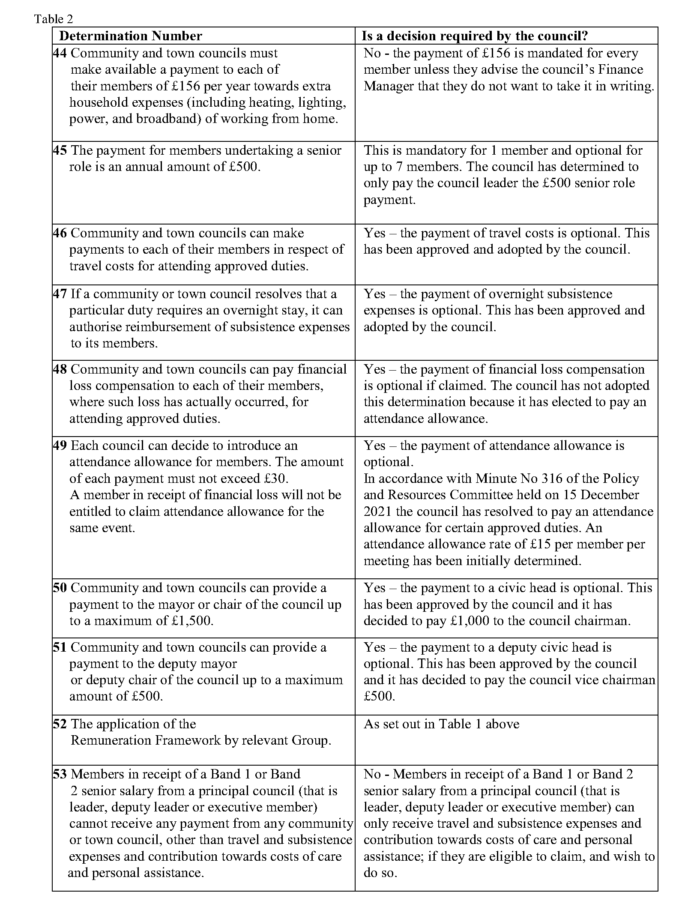

Table 2 sets out the IRPW’s determinations for the community and town council sector for 2022/23 and if a decision is required by the council in respect of each one.

Determination number 44 in the table has subsequently been updated since the publication of the determinations of the community and town council sector for 2022/23 and this update has been reflected in the table.

All members are eligible to be paid the £156 as set out in Determination 44 normally from the start of the financial year; unless they are elected later in the financial year, in which case they are eligible for a proportionate payment from that date.

Other amounts payable to members in recognition of specific responsibilities for instance, the council leader(Determination 45), the council chairman or vice chairman (Determinations 50 and 51) are payable from the date when the member takes up the role during the financial year. For the election year the same arrangements as set out above will apply.

It is a matter for the council to make, and record:

- when the payment is actually made to the member;

- how many payments the total amount payable is broken down into;

- and whether and how to recover any payments made to a member who leaves or changes their role during the financial year.

Payments in respect of Determinations 46 and 47 are payable when the activity they relate to has taken place.

Click to view Councillors Allowances for 2023-2024

Click to view Councillors’ Allowances for 2022-2023

Click to view Councillors’ Allowances for 2021-2022

Click to view Councillors’ Allowances for 2020-2021

Click to view Councillors’ Allowances for 2019-2020

Click to view Councillors’ Allowances for 2018-2019

Click to view Councillors’ Allowances for 2017-2018

Click to view Councillors’ Allowances for 2016-2017

Click to view Councillors’ Allowances for 2015-2016

Click to view Councillors’ Allowances for 2014-2015